Roll Back The Tax Increase on CA Cannabis

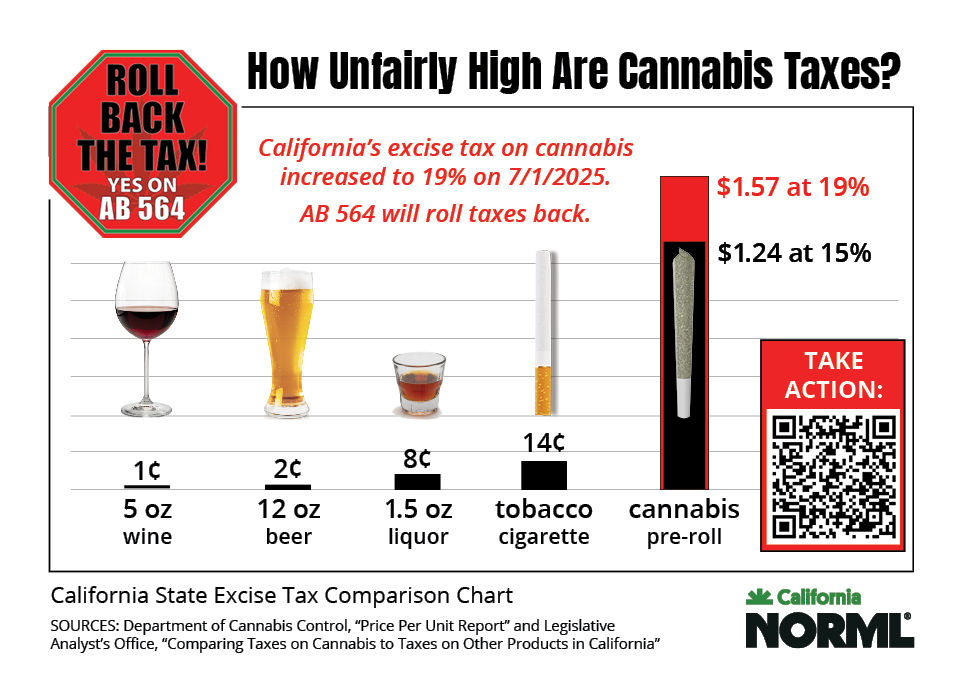

California increased its excise tax on cannabis from 15% to 19% on July 1, 2025. Already the increase is proving to be detrimental to California cannabis businesses and consumers.

AB 564 would roll back the tax increase as soon as October 1. It has passed both houses of the legislature and will head to the Governor's desk.

The Dept. of Cannabis Control estimates that 6 out of every 10 cannabis sales in CA is from the illicit, untaxed market. High taxes and restrictive regulations are choking the legal cannabis industry, and sending consumers to the illicit market, where products are untested and untaxed.

Other states like Michigan that have more favorable tax structures have more cannabis sales per capita than California. If California were on par with Michigan, we would be generating an estimated $13 billion in annual sales, and the state would be collecting substantially more tax revenue. Instead, the taxable sales for cannabis in 2024 was only $4.6 billion.