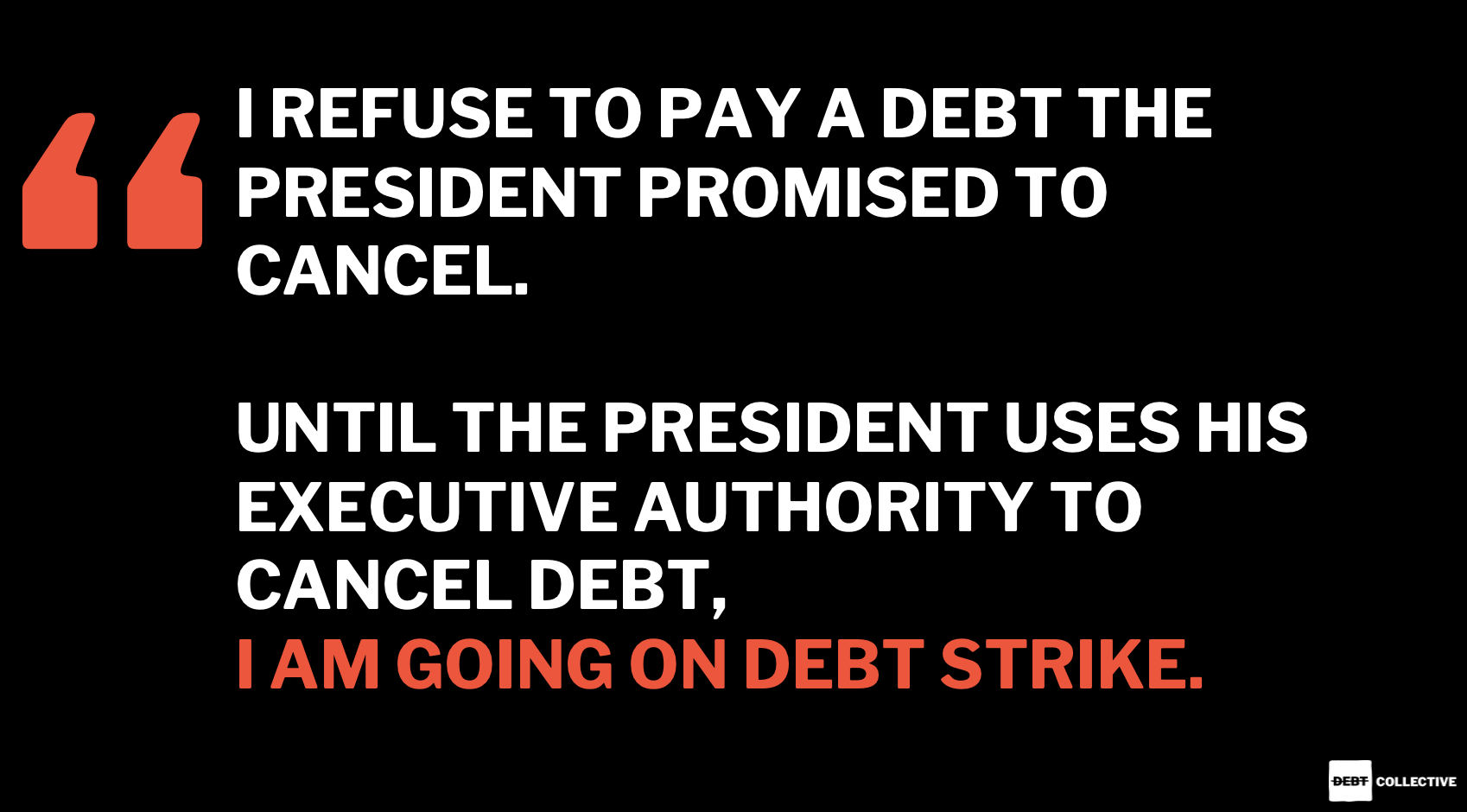

I refuse to pay a debt the President promised to cancel.

I refuse to pay a debt the President promised to cancel.

Until the President uses his executive power through the Higher Education Act to cancel student debt for EVERYONE,

** To learn more about the President's power to IMMEDIATELY cancel all federal student debt,

check out this video.**