OPPOSE SB 76: Elimination of Property Taxes

It is not enough to fund all public schools equally, we have to fund them equitably. Years of systematic discrimination through housing and codified inadequacies in funding have left students unable to receive a quality education in Pennsylvania. It’s time to change that.

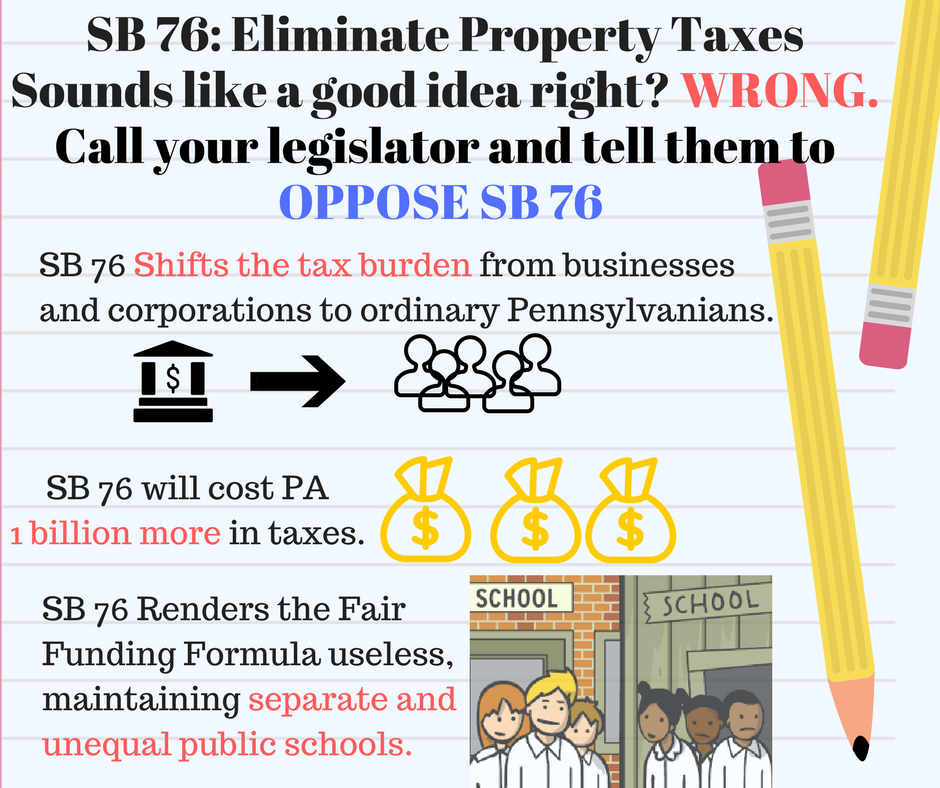

SB 76 would hurt Pennsylvania's public schools and it would undermine the Fair Funding Formula. Here are some other reasons to oppose this legislation:

There is no way to accurately project whether these increases would garner the revenue necessary to fund our public schools. Property taxes provide for 41% of the budget for PA’s Public Schools. In order to replace that local revenue loss (around 14 billion dollars), the bill would hike the state personal income tax from 3.07 to 4.95 percent and raise the sales tax from 6 to 7 percent. The items eligible for sales tax would also widen to include purchases such as groceries, some clothing and certain professional services.

Eliminating the property tax would disproportionately affect the poor and non-property owners. This bill shifts the tax burden to those who do not own property (the poor) and to the highest consumer base (working families). Despite what supporters say, eliminating property taxes will not incite landlords to lower the rent. Rent never goes down.

SB 76 makes it impossible for local communities to raise revenue for their school districts. The only way a school board would be able to increase the PIT for their community would be if people in the community voted to do so. Sounds fair right? Well, no one is ever going to vote to have their taxes raised. This means that public schools will go unfunded. In 2016, 85% of school districts needed to levy property taxes to be able to fund their public schools. The state funding provided is simply not enough.

TAX SHIFT FROM BUSINESSES TO INDIVIDUALS. Eliminating property taxes across the board means that the property tax burden carried by businesses will be shifted to individuals in the form of increased PIT and SUT. Across Pennsylvania, businesses are currently paying approximately $2.75 billion in property taxes, which will be shifted away from those businesses. Property tax elimination gives Walmart a free ride at the expense of individuals and small businesses.