PLEASE SUPPORT SB 1059

SB 1059 (Bradford) amends the definition of gross receipts in the Sales and Use Tax Law to exclude the amount of any state cannabis excise tax and sales and use tax imposed on a cannabis retailer, preventing double taxation at the local level.

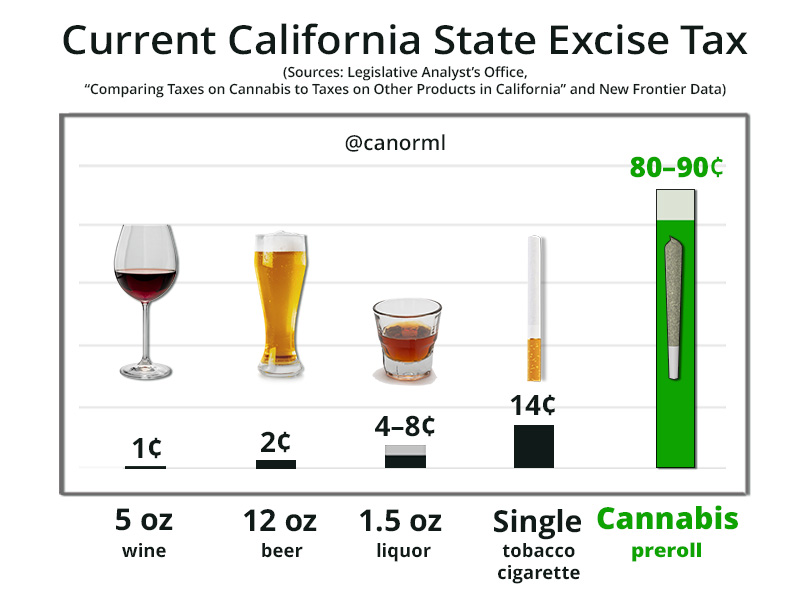

Cannabis is already heavily overtaxed relative to comparable goods in California. Compounding taxes simply leads to an artificially inflated purchase price and incentivizes consumers to purchase cannabis from the unlicensed, untested, and untaxed market.