Stop Higher Taxes on Cannabis in California

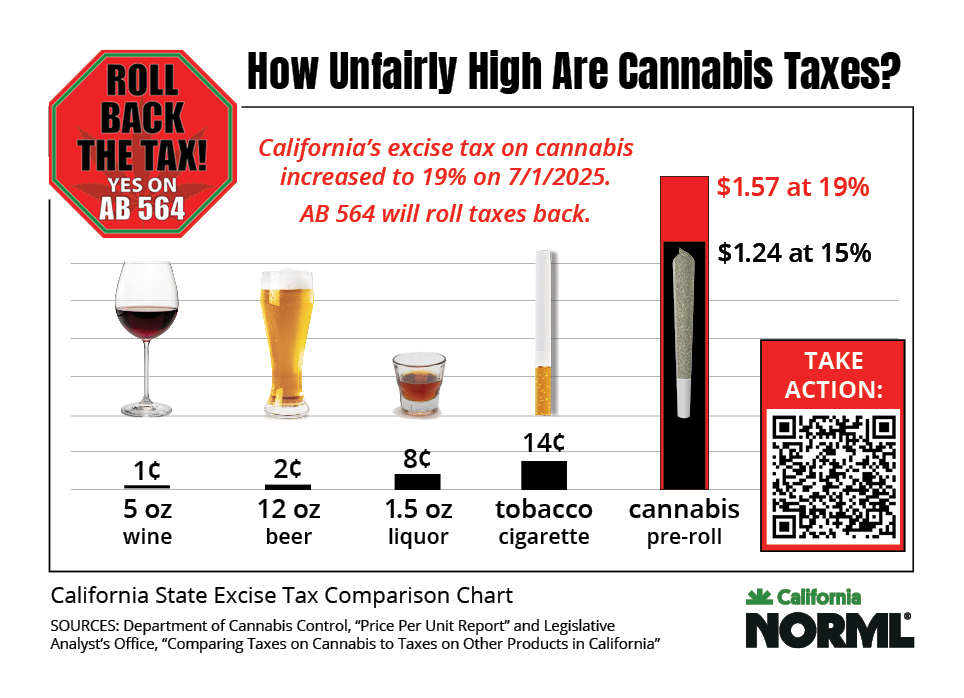

California increased its excise tax on cannabis from 15% to 19% on July 1, 2025.

Cannabis is already unfairly taxed vs. similar products in California. And since cannabis is also subject to sales taxes and local taxes, and these taxes are compounded at the retail level, consumers are already paying as much as 39% tax on cannabis purchased at licensed stores in our state.

High taxes and restrictive regulations are chocking the legal cannabis industry, and sending consumers back to the illicit market, where products are untested and untaxed. Medical marijuana patients in particular are affected by high taxes and a lack of diverse products that address their medical needs.

AB 564 would amend the law that requires a tax hike on cannabis in California, and roll back the tax increase as soon as October 1. Please write to your Senator and tell them we need lower taxes, on cannabis, not higher ones.