Pay-As-You-Stay (PAYS) and Homeowners Property Tax Assistance Program (HPTAP) Program Interest Form

If you'd like more assistance enrolling in PAYS or HPTAP, we are happy to connect you with a representative from MACC Development or the Eastside Community Network to personally walk you through the process. We will send you all the necessary information after completing this form.

What is Pay as You Stay?

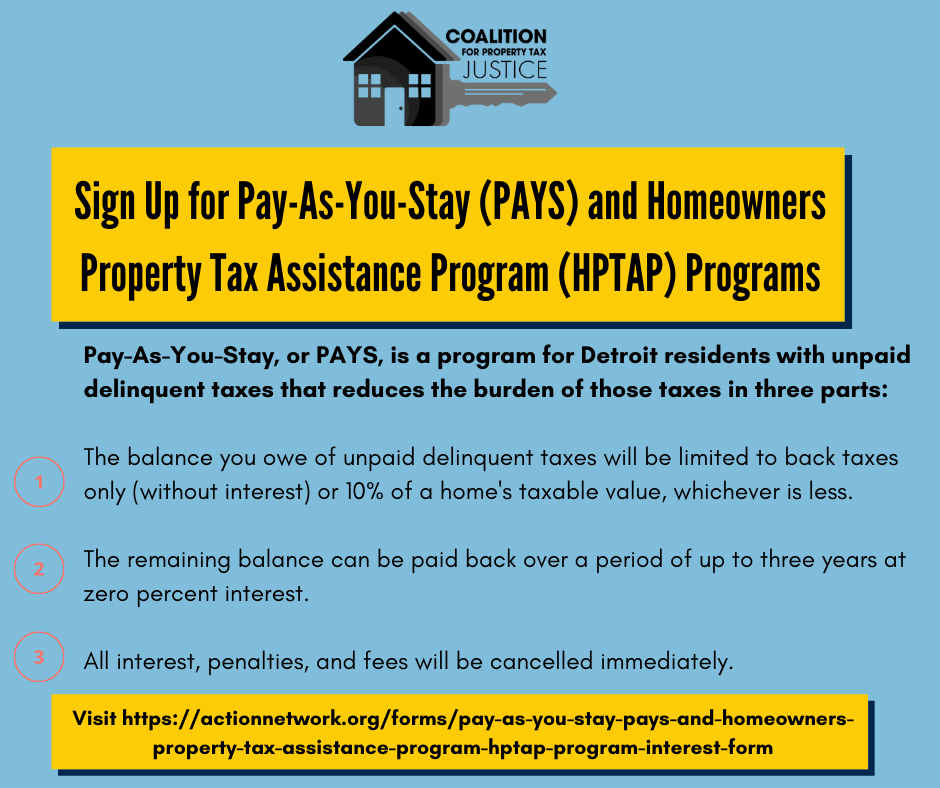

Pay-As-You-Stay, or PAYS, is a program for Detroit residents with unpaid delinquent taxes that reduces the burden of those taxes in three parts:

The balance you owe of unpaid delinquent taxes will be limited to back taxes only (without interest) or 10% of a home's taxable value, whichever is less.

The remaining balance can be paid back over a period of up to three years at zero percent interest.

All interest, penalties, and fees will be cancelled immediately.

Why should I enroll in PAYS?

In violation of the Michigan State Constitution, the City of Detroit has been overtaxing tens of thousands of Detroit homeowners to the tune of $600 million. If your home is worth $50,000 or less, the City is likely still overcharging you.

The Coalition for Property Tax Justice is fighting tirelessly to bring an end to these illegally inflated taxes, as well as compensate affected Detroit residents. In the meantime, PAYS provides the opportunity to alleviate some of the burden of these illegally high property taxes.

Am I eligible for PAYS?

PAYS is only available to Detroit residents already enrolled in the Homeowners Property Tax Assistance Program. This program, also known as HPTAP, is designed to exempt Detroit homeowners from their current year of property taxes based on household income and circumstances. HPTAP offers property tax exemption at either 100%, 50%, or 25% depending on household income level and the number of members per household. The points of income eligibility are as follows:

How do I enroll in PAYS?

The deadline to apply for HPTAP in 2021 is December 13. To apply for HPTAP, use the digital application form, or request a physical copy by calling 313-224-3035 or emailing BoardofReview@DetroitMI.gov. You must enroll in HPTAP in order to be eligible for PAYS.

Once enrolled in HPTAP, you can then sign-up for PAYS through the Wayne County website or by making an appointment with the Wayne County Treasurer's Office.