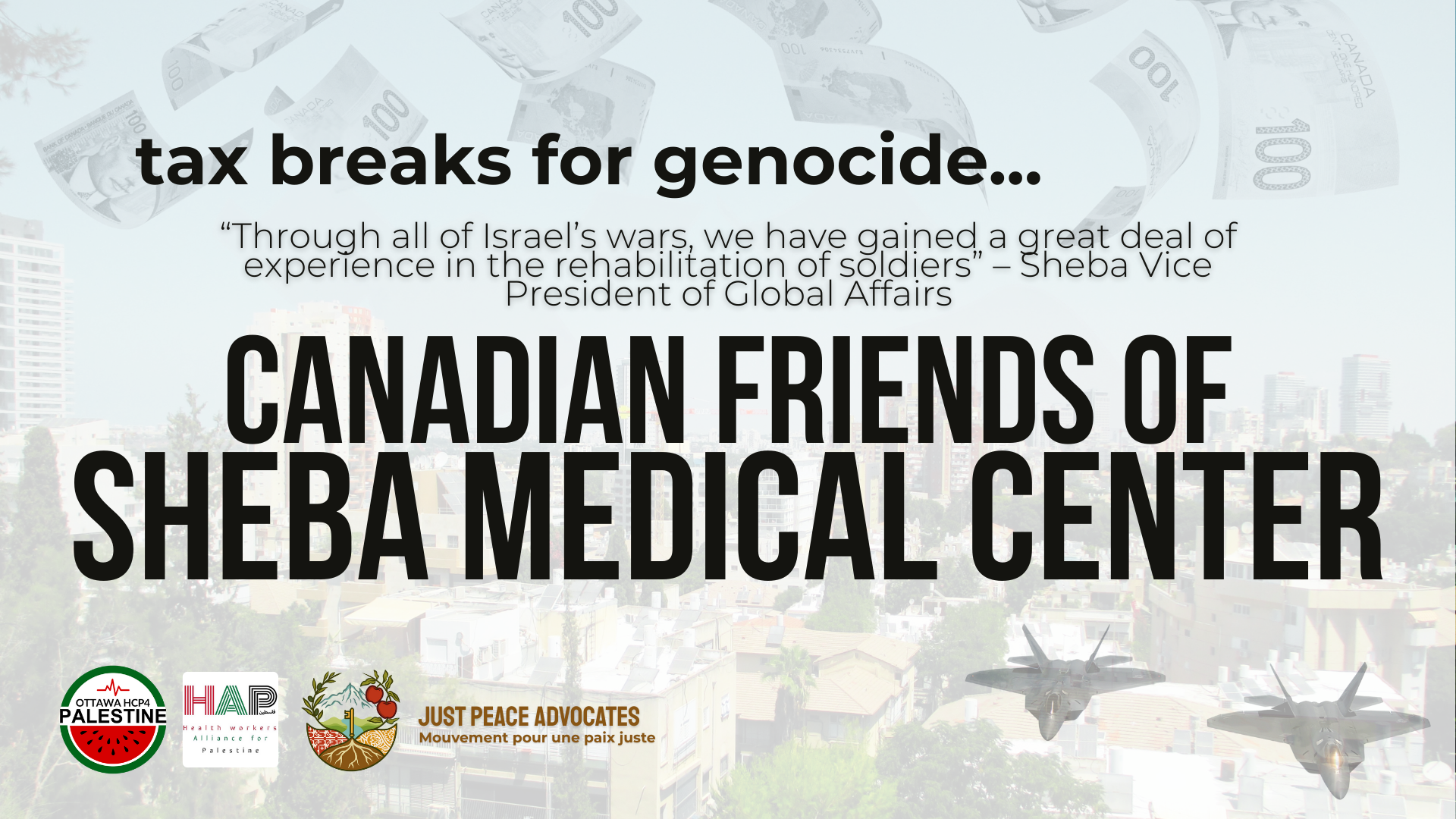

Tax Breaks for Genocide: Canadian Friends of Sheba Medical Center

Canadian Friends of Sheba Medical Center (CFSMC) is a Canadian registered charity that appears to exist solely to support the Sheba Medical Center in Jaffa (Tel Aviv).

Over the last 12 years, CFSMC sent nearly $28 million to the Sheba Medical Center in Israel. Notably, over the same period, they reported $0 going to any other registered charities/qualified donees. In 2024 alone, CFSMC sent $9,684,320 to Sheba Medical Center.

Sheba Medical Center in Israel is and always has been deeply connected to the Israeli military. Sheba was established in 1948 by David Ben-Gurion: “I asked Chaim Sheba to create the state’s first military hospital at Tel Hashomer.” Now, Sheba continues to be the main hospital serving the Israeli military. CFSMC report that “Sheba is also where 100% of injured IDF soldiers go for rehab.”

Based on CFSMC’s financial records and publications, their whole purpose is to support the Sheba Medical Center in Israel. As Sheba Medical Centre is focused on supporting the Israeli military, it appears as though CFSMC is in violation of the Income Tax Act, War Crimes and Crimes Against Humanity Act, CRA Policy — including Public Benefit test #4, CG-002, international law — including the ICJ Advisory Opinion of July 2024.

Specifically, the CRA’s own policy states:

Under Canadian law, most activities that are charitable in Canada are also charitable abroad. However, the courts have stated that some activities that are charitable in Canada may not be charitable when carried on in a different country. For example, it is charitable to increase the effectiveness and efficiency of Canada’s armed forces, but it is not charitable to support the armed forces of another country.

In a detailed complaint to the CRA, we have submitted evidence of Sheba’s support for and connection to the Israeli military. As well, the Sheba Medical Center is working directly with major arms company Elbit Systems, which is the largest supplier of arms to the Israeli military. You can review examples of the evidence online.

We demand the CRA:

1. Review CFSMC’s donations to institutions that support a foreign military and illegal occupation.

2. Investigation violations of the Income Tax Act, CRA policy, international and (other) domestic laws.

3. Ensure CFSMC has has direction and control over the use of their organizational resources, if any undue benefit is being provided to individuals, if they maintained proper books and records, and any other considerations under income tax law related to charities.

4. Investigate their complicity in support of providing funds to support a foreign military, a foreign state who should be providing medical services to its own military and its veterans, and in aiding and abetting war crimes, and genocide.

5. Commence the formal process of revoking the charitable status of CFMSC.

Campaign sponsored by Just Peace Advocates, Ottawa Health Care Professionals for Palestine, and Health workers Alliance for Palestine.