Divest Alaska Permanent Fund from fossil fuels

Board of Trustees, Alaska Permanent Fund Corporation

Alaskans have been calling for divestment of the Permanent Fund from fossil fuels for more than 25 years. Fund managers have rejected citizen appeals on the grounds that the Fund is strictly mandated to maximize return on investment.

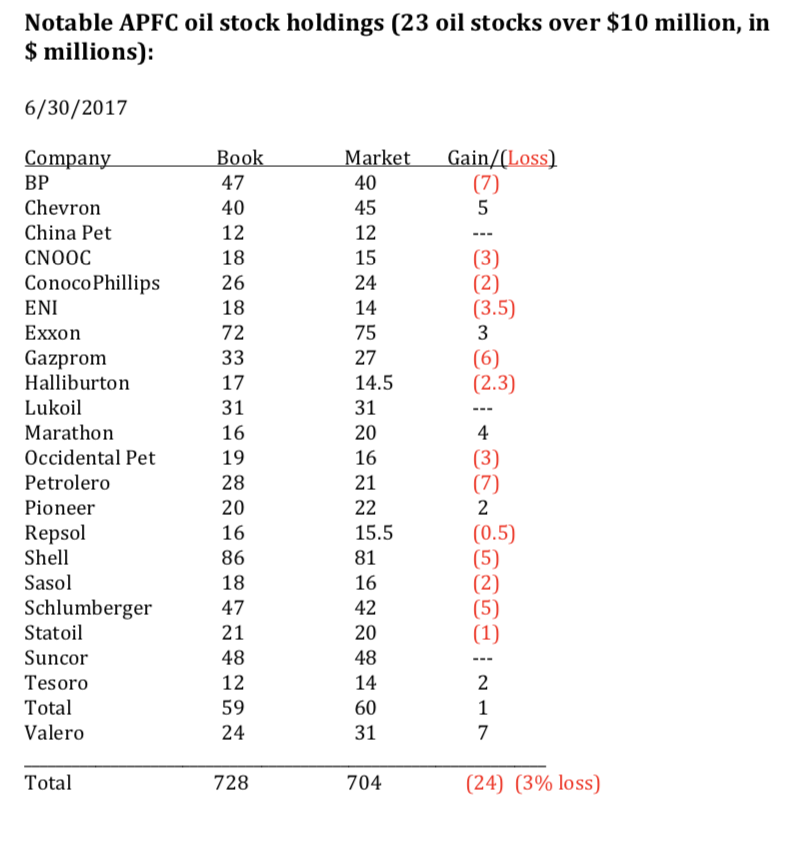

Explosive growth in renewable energy, volatile but downward trending oil and natural gas prices and Paris Accord commitments are strong indicators that the era of fossil energy is coming to a close; investing in fossil fuels is increasingly high risk and already costing Alaskan’s millions in lost Fund revenue annually (see Table 1 below).

The world’s largest sovereign wealth fund - the $1 trillion Norway Fund – is currently exploring divestment of its $37 billion oil and gas holdings, based “exclusively on financial arguments”. The Bank of France and other major financial institutions are doing the same. It’s time for Alaska to follow suit.

The world’s largest sovereign wealth fund - the $1 trillion Norway Fund – is currently exploring divestment of its $37 billion oil and gas holdings, based “exclusively on financial arguments”. The Bank of France and other major financial institutions are doing the same. It’s time for Alaska to follow suit.

Tell Alaska’s Permanent Fund Corporation managers it’s time to divest Alaska’s Permanent Fund from high-risk fossil fuel investments.

Update: We originally presented this petition to the Board of Trustees at the quarterly meeting on November 2017 in Juneau. On May 23, 2018, in response to our petition, the Trustees held a panel on environmental, social and governance (ESG) investing at the quarterly meeting in Anchorage. Unfortunately Trustee leadership rejected advise of the Funds chief financial advisor and Blackstone, Goldman Sachs and Morgan Stanley experts, to implement ESG standards.

We must keep pushing.

To:

Board of Trustees, Alaska Permanent Fund Corporation

From:

[Your Name]

Alaska citizen-shareholders have called upon the Alaska Permanent Fund Corporation (APFC) to establish socially responsible investment screening for more than 25 years. The APFC has consistently denied our requests on the grounds that it is directed to “maximize return-on-investment.”

Today, the rapid rise of renewable energy markets, unstable and down-trending oil and natural gas prices, and Paris Accord commitments to reach net-zero carbon emissions by mid-century are clear indicators that maximum return-on-investment is no longer possible from fossil fuel holdings.

Emissions from fossil fuels are a major driver of global climate change that threatens Alaska’s coastal villages, statewide infrastructure, our entire way of life, and is projected to cost the state billions of dollars over the coming decades.

The Funds continued heavy fossil fuel investments are very likely already costing Alaskans hundreds of millions of dollars in realized losses and unrealized potential gains. For example, as of June 2017 the Funds approximately $700 million in oil stocks alone have collectively lost over $24 million in today’s market (see Table 1).

Further, this substantial investment could have earned a higher return on investment from other more profitable holdings. As such, these fossil fuel investments clearly violate APFC’s “highest return on investment” mandate cited as the primary reason for denying citizen shareholder's previous divestment requests.

Put simply, fossil fuel holdings are a bad investment.

Many large financial institutions across the world have realized the risk posed by fossil fuel holdings, and are divesting.

France’s largest bank, BNP Paribas SC, recently announced it would no longer do business with companies whose main activity stems from oil and natural gas obtained from shale, oil sands, or oil or gas projects in the Arctic region.

The $1 trillion Norway Fund – the world’s largest sovereign wealth fund (built from oil revenue like the Alaska Fund) – is currently considering full divestment of its $37 billion+ oil and gas holdings, based “exclusively on financial arguments.”

Furthermore, a growing number of energy experts predict a decline in fossil fuel value:

“Shell’s chief executive has warned of “lower forever” rather than BP’s “lower longer.” Dieter Helm, an influential energy economist, believes oil prices will carry on falling forever.”

“…climate change and the environment did not even merit an aside – the advice is all about a fund manager maximising value for their client.”

The Guardian, Nov. 11, 2017 (Emphasis added)

The APFC has a clear social, ethical, and fiduciary obligation to divest from fossil fuels. We urge you to begin immediate divestment from all fossil fuel holdings.

We request that APFC order an expedited, independent evaluation of the financial risk posed by the Fund’s fossil fuel holdings and report the results and recommendations of the evaluation to the Board of Trustees and Alaska citizen-shareholders on or before March 1, 2018; and then act upon its recommendations.

Sincerely,

______________

Links to more information:

https://www.theguardian.com/environment/fossil-fuel-divestment

https://www.theguardian.com/environment/2016/dec/12/fossil-fuel-divestment-funds-double-5tn-in-a-year

https://www.theguardian.com/environment/2015/jun/23/a-beginners-guide-to-fossil-fuel-divestment

https://www.theguardian.com/environment/2017/oct/03/catholic-church-to-make-record-divestment-from-fossil-fuels

https://gofossilfree.org/divestment/what-is-fossil-fuel-divestment/

https://www.huffingtonpost.com/entry/the-global-divestment-movement-is-unstoppable_us_59194fb4e4b0bd90f8e6a6fa

https://www.theguardian.com/business/2017/nov/19/norway-fund-sells-out-of-oil-fossil-fuels-starting-to-look-risky-norges-bank